{results_count} Math videos for {phrase}

Displaying {results_count} results of {results_count_total}

Simple Interest and Compound Interest

🎬 Video Tutorial

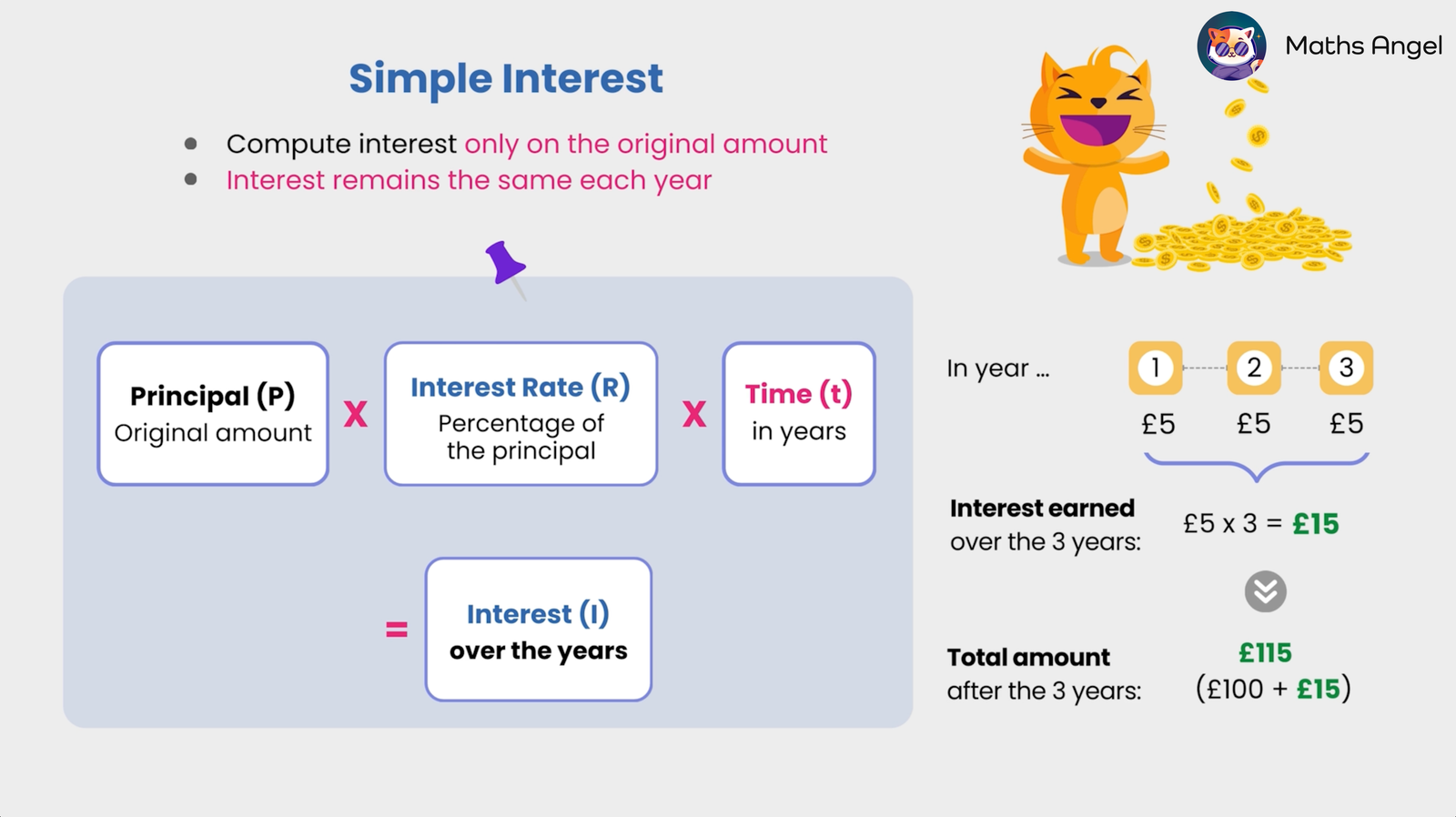

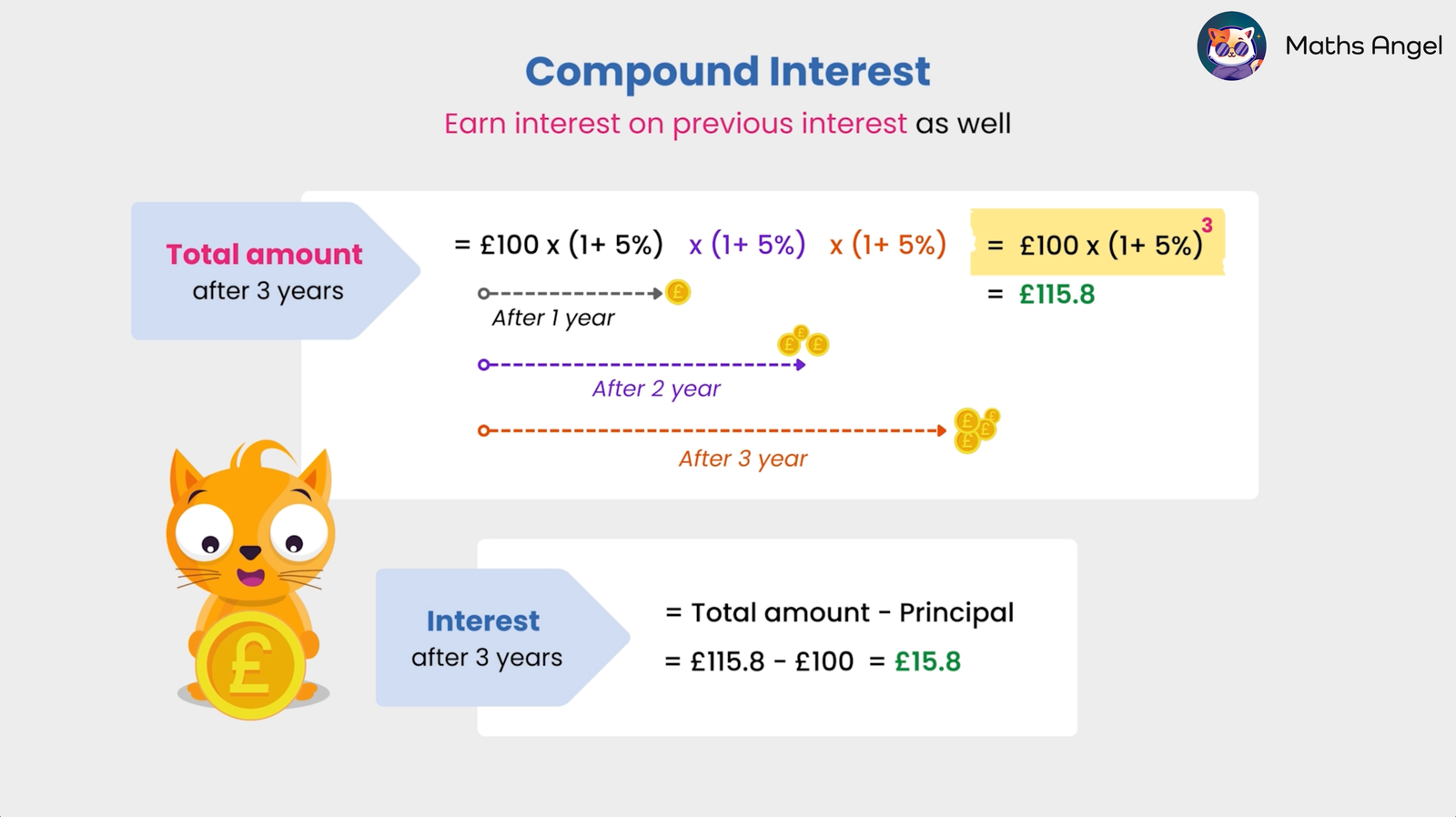

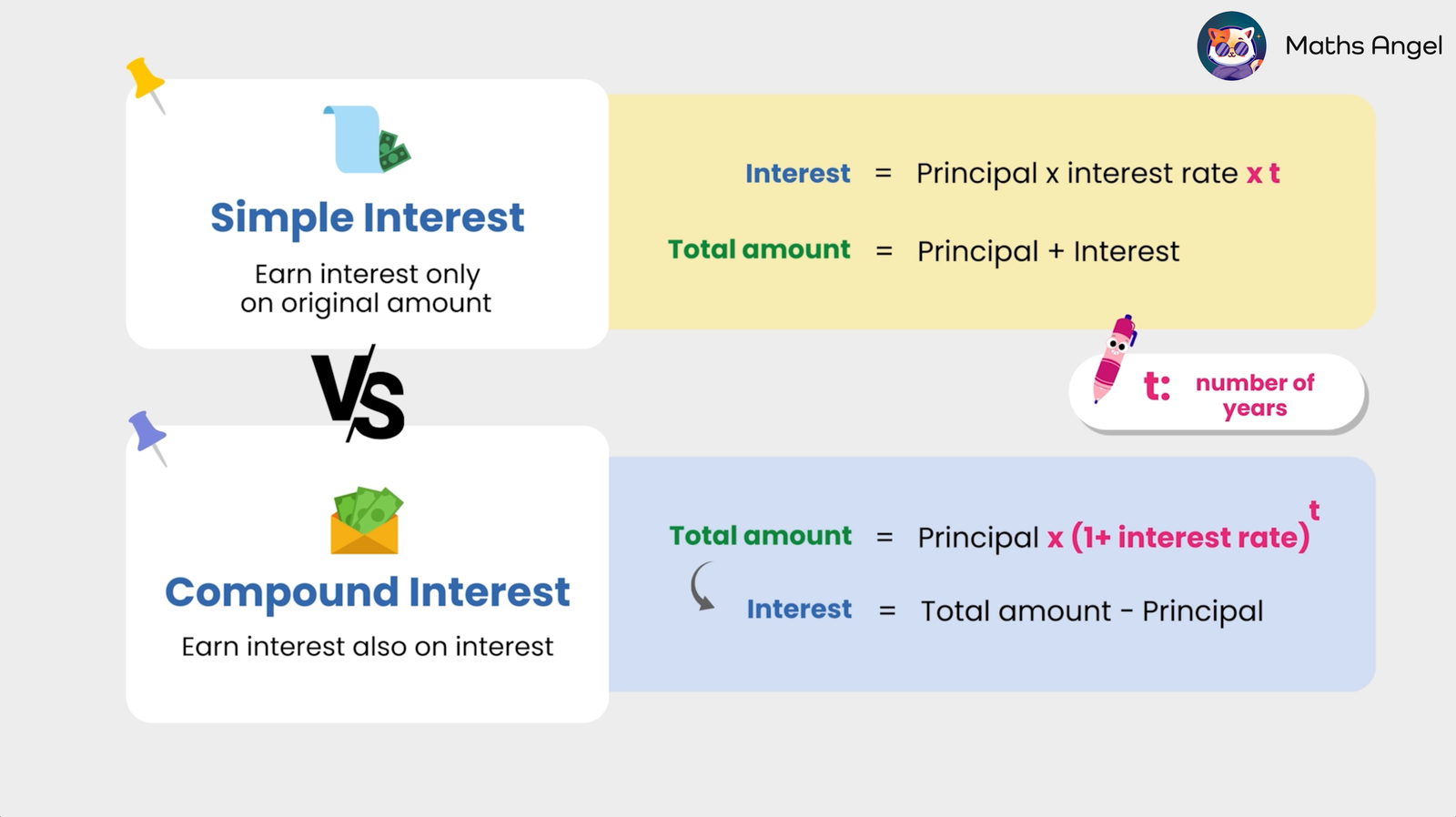

(0:01) What is Simple Interest (Formula)? Simple interest is calculated only on the original amount (principal), meaning the interest does not change each year. It follows the formula $I = P \times R \times t$, where $P$ is the principal, $R$ is the interest rate, and $t$ is the time in years.(0:56) How to Calculate Simple Interest Over Years? For example, if you invest £100 at 5% per year for 3 years, you will earn £5 per year in interest. Over 3 years, this totals 3 × 5£ = £15 in interest. The total amount after 3 years is £100 + £15 = £115.(1:33) What is Compound Interest (Formula & Example)? Compound interest grows each year because interest is earned on both the initial principal and the accumulated interest. The formula is $Principal \times (1 + \text{Interest Rate})^t$, where $t$ is the number of years.(2:57) What’s the Difference between Simple Interest and Compound Interest? Simple interest is calculated only on the original principal, while compound interest is calculated on the principal plus any previously earned interest.

📂 Revision Cards

🍪 Quiz Time - Practice Now!

0%

🎩 AI Math Solver (ChatCat)

Need math help? Chat with our AI Math Solver at the bottom right!

0

0

votes

Article Rating

0 Comments

Newest

Oldest

Most Voted

Inline Feedbacks

View all comments